Table of Contents

In the current digital age where everything and everyone is interconnected, cybersecurity has turned into a major concern. Similar to many other jurisdictions previously regulated, the European Union (EU) once again had to enact robust measures for safeguarding its digital infrastructure.

This is how the Network and Information Systems Directive 2 (NIS2) and the Digital Operational Resilience Act (DORA) were conceived. They’re actually the EU’s forward-thinking responses designed to fortify cybersecurity practices and ensure operational resilience across critical sectors.

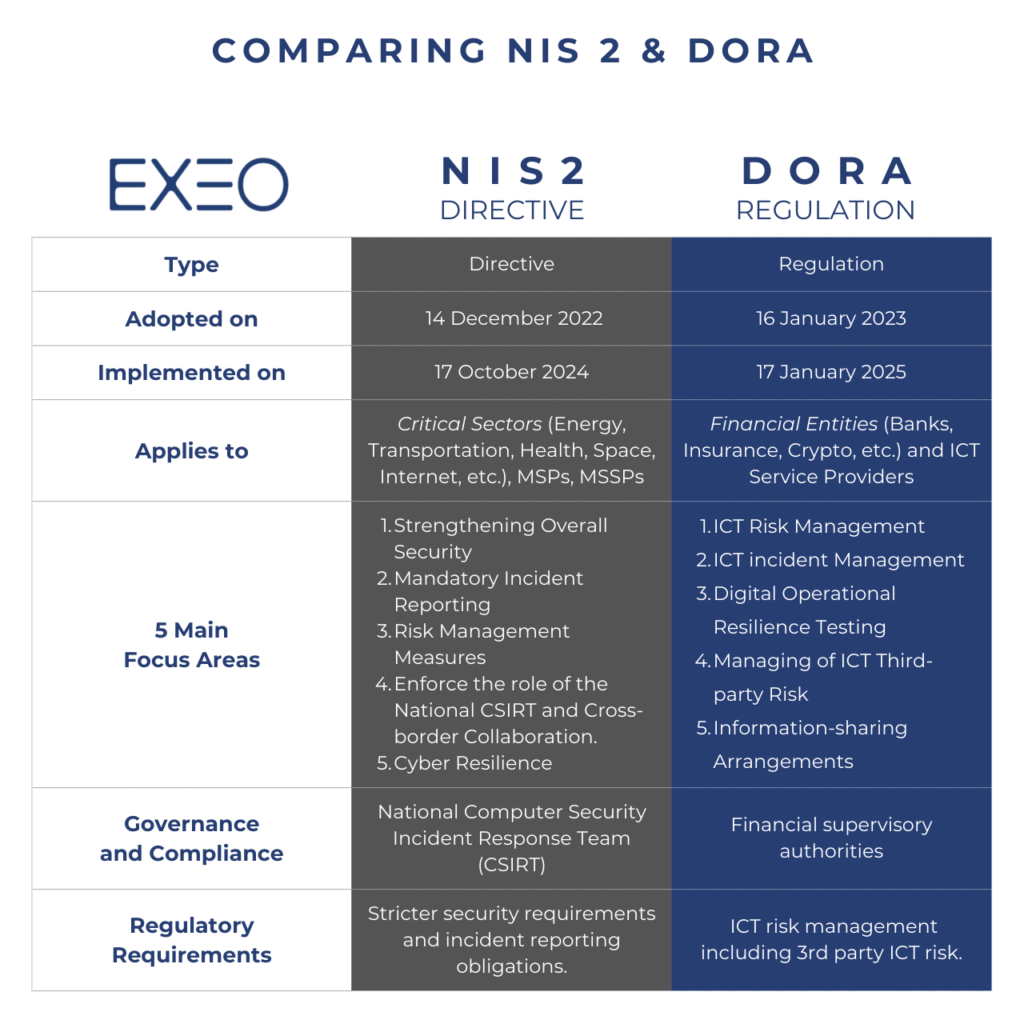

The NIS2 targets a wider array of sectors and imposes firm security protocols to combat the evolving cyber threat landscape. DORA, on the other hand, establishes rigorous requirements focused on the financial sector.

Together, these regulations have turned vital for the EU’s digital ecosystem and the society’s resilience. Throughout this post, we’ll understand both the EU NIS2 directive as well as the DORA regulation and we’ll be able to compare them.

Before we get into the details of both regulations, let’s briefly cover the scope and objectives of each briefly.

Overview of NIS2

NIS2 expands on the original Network and Information Security (NIS) Directive by broadening its scope and enhancing cybersecurity across the EU. Its key objectives include strengthening security measures across critical sectors to establish uniform incident reporting standards. It also aims at promoting national and EU-wide cooperation in cybersecurity efforts.

- Key Sectors: NIS2 extends to a wide array of sectors considered vital for the economy and the society, such as energy, transport, banking, space, Internet and health, among others.

- Enhanced Security Protocols: It mandates tight security measures and incident reporting for both essential and important entities.

- Cross-border Collaboration: Aimed at strengthening EU-wide collaboration to manage and mitigate cyber threats efficiently.

The NIS2 Directive represents a critical evolution in the European Union’s approach to cybersecurity. This makes NIS2 a significant expansion on strengthening the region’s collective cyber defences.

As an improvement on the original Network and Information Security Directive, the EU Commission designed NIS2 to address the increasingly complex and evolving cyber threats. This only makes sense since the EU’s internal markets have been a prime target.

NIS2 also broadens the range of sectors considered as essential for the maintenance of societal and economic activities.

The new NIS 2 directive sets out to achieve a high common level of cybersecurity across member states by imposing more stringent security requirements and incident reporting obligations on both essential and important entities. These requirements are not only more comprehensive but also tailored to the specific needs and risk profiles of the sectors and entities it covers.

By doing so, NIS2 aims to close any gaps in cybersecurity defences that could be exploited by bad actors. If anything, it improves the resilience of the EU’s critical digital infrastructure.

On top of everything, the directive emphasizes the importance of cross-border cooperation and information sharing among member states. The goal is to recognize that cyber threats do not abide by national boundaries. It establishes mechanisms for coordination and exchange of information to enable a collective response to cyber incidents.

As a result of all of these approaches, the EU’s ability to prevent, detect, and respond to cyber threats should become more efficient and effective.

So, the NIS 2 summary comes to the EU’s commitment to safeguarding its digital economy and society against cyber threats through a unified, comprehensive approach. It aims to improve cybersecurity resilience, promote cooperation, and provide a trustworthy digital environment for all citizens and businesses.

Overview of DORA

The Digital Operational Resilience Act (DORA) focuses specifically on the financial entities, aiming to increase its resilience against ICT-related disruptions. The directive outlines requirements for a wide range of financial entities to establish comprehensive digital operational resilience frameworks.

- Financial Entities Covered: The DORA regulation applies to banks, insurance companies, investment firms, and even crypto-asset service providers and third party ICT providers.

- Operational Resilience Measures: Includes ICT risk management, incident reporting, digital operational resilience testing, and third-party risk management.

- Strengthening the Financial Sector: Ensures that the financial sector can withstand and quickly recover from digital disruptions, preserving the integrity and stability of the EU’s financial markets.

The Digital Operational Resilience Act (DORA) is a landmark regulation within the European Union. Unlike NIS2, it’s specifically crafted to fortify the financial sector’s resilience to ICT (Information and Communication Technology) risks.

One of the biggest narratives of DORA is that it recognizes the importance of digital infrastructure in the financial industry. So, it created a foolproof framework to ensure that banks, financial institutions, and even emerging financial entities like crypto-asset service providers can withstand, respond to, and recover from a wide array of digital disruptions.

At its core, DORA mandates the implementation of rigorous ICT risk management capabilities. It includes establishing resilient digital operational infrastructures, thorough testing for digital operational resilience, and detailed incident reporting mechanisms.

This approach not only aims at mitigating the impact of potential ICT-related incidents but also increases the overall stability and integrity of the EU’s financial markets.

One of the key aspects of DORA is its inclusive scope that applies to a broad spectrum of financial entities. This inclusivity ensures that the regulation addresses the digital operational resilience of the financial system as a whole, rather than in isolated segments.

Furthermore, DORA is big on the importance of third-party risk management. It acknowledges that many financial entities rely on external service providers for critical ICT services. By making organizations do thorough due diligence and contractual arrangements, DORA’s purpose is to extend its resilience standards throughout the supply chain.

Comparative Analysis of NIS2 and DORA

When examining NIS2 and DORA in the context of their application to businesses, they may seem very complex separately. So, let’s do a comparative analysis that reveals distinct yet complementary frameworks designed to improve cybersecurity and operational resilience across different sectors within the EU.

NIS2 primarily targets a broad range of sectors considered essential for societal and economic well-being. We’re talking energy, transport, healthcare, and digital infrastructure. Its focus is on enhancing cybersecurity measures across these sectors by implementing stringent security protocols and incident reporting requirements.

This directive encourages businesses within its scope to adopt comprehensive risk management practices and to report significant cyber incidents. As a result, it improves the overall cybersecurity positioning of the EU.

On the other hand, DORA is specifically tailored for the financial sector. It works in tandem with financial entities, such as banks, insurance companies, and investment firms. The goal is to make sure they can maintain operational resilience in the face of ICT-related disruptions.

This includes mandatory ICT risk management, incident reporting, digital operational resilience testing, and management of third-party risks.

DORA’s use case for businesses within the financial sector is clear. It’s here to safeguard the continuity and integrity of financial services against increasing digital threats.

Comparatively, while both directives are designed to supercharge security and resilience. While NIS2 offers a broader, sector-wide approach to cybersecurity, DORA, covers the specific needs and challenges of the financial industry.

For businesses, compliance with NIS2 or DORA (or both, depending on the sector) means not only meeting regulatory requirements but also contributing to a safer, more resilient digital and financial ecosystem in Europe.

Together, they present a dual framework that addresses both broad and sector-specific needs, ensuring that businesses are well-prepared to navigate the complexities of today’s cyber and digital operational challenges.

Here is a table summarizing both NIS2 and DORA

Impact of NIS2 and DORA on Businesses and Organizations

DORA introduces strict requirements across five main pillars:

- ICT risk management

- Incident reporting

- Resilience testing

- Third-party risk management

- Oversight of critical third-party providers

DORA mandates entities to undertake comprehensive revisions of their ICT risk management frameworks. It makes sure that management bodies are directly responsible for digital operational resilience strategies.

Incident reporting under DORA demands improved capabilities in handling ICT incidents, including classification and root cause analysis. Moreover, resilience testing requires those entities to conduct annual security tests and address vulnerabilities in the shortest deadlines.

The DORA EU regulation also tightens the reins on third-party risk management and oversight to set specific contractual terms for ICT outsourcing.

NIS2, on the other hand, works on achieving a high level of cybersecurity across EU Member States. While both DORA and NIS2 focus on digital resilience, DORA is curated to complement NIS2 by providing specific provisions that avoid overlap. If anything, it ensures a cohesive and comprehensive approach to digital operational resilience across the EU.

For businesses and organizations, these regulations mean they must undertake a proactive overhaul of their digital resilience strategies. Business entities must now ensure that their ICT frameworks, incident response plans, and third-party contracts all align based on these requirements.

The intersection of DORA with other regulations, such as the General Data Protection Regulation (GDPR), further showcases the need for an integrated approach to compliance, where adhering to DORA’s mandates also supports GDPR compliance, particularly in managing ICT-related incidents and data breaches.

Achieving compliance with Exeo

In recent years complying with the EU’s cybersecurity regulations have become quite complex. For this reason, businesses face a challenge to adapt with evolving standards like GDPR, NIS2 and DORA.

This is where our offering as a compliant managed security services provider becomes invaluable. We strongly believe a clear roadmap needs to be crafted based on strong foundations of governance and cybersecurity frameworks, before diving into and providing cybersecurity services.

Through our cybersecurity governance, risk and compliance services, we guide our clients in adopting a cyber resilience hygiene equipping them with cutting-edge cybersecurity services in order to execute on the plan and stay safe.

Our practice ensures that organizations not only meet compliance requirements and tick the boxes but it also safeguards them against the ever-present threats of cyber attacks.